A settlement deed serves as a vital legal document that facilitates the transfer or division of property and assets between parties, often in situations involving disputes, separations, or family matters. It outlines the rights and responsibilities of each party while ensuring a legally binding agreement for fair distribution. Understanding the nuances of this document is essential for anyone navigating complex property issues, whether due to divorce, inheritance, or other circumstances.

In many cases, settlement deeds can streamline processes that might otherwise be prolonged by litigation. They not only clarify the intentions of the parties involved but also establish a formal record that can prevent future disputes. Anyone involved in property transactions or legal disputes should recognize the importance of having a well-drafted settlement deed to protect their interests.

Navigating the intricacies of settlement deeds can be daunting, but with the right information, individuals can make informed decisions. This article will explore what a settlement deed is, the various types it encompasses, and the key considerations to keep in mind when drafting or signing one.

Key Takeaways

- A settlement deed is a legally binding document detailing property and asset distribution.

- There are different types of settlement deeds depending on the nature of the agreement.

- Understanding legal requirements can help prevent future disputes in property matters.

Explanation of a Settlement Deed

A settlement deed is a crucial legal document in property disputes and asset division. It establishes the terms under which parties agree to resolve their conflicts regarding property ownership and distribution.

Definition and Purpose

A settlement deed is a formal agreement that outlines the resolution of disputes between parties. It is often used in contexts such as divorce, inheritance, or property disagreements. The primary purpose is to provide clarity and legal validation for the parties involved.

This document serves as a binding contract, ensuring that all agreed terms are enforceable under law. By clearly detailing the rights and responsibilities of each party, it minimizes the potential for future disputes. In jurisdictions like India, settlement deeds are governed by established legal frameworks such as the Transfer of Property Act, 1882.

Key Components

Several key components are typically included in a settlement deed to ensure its effectiveness:

- Parties Involved: This section identifies all parties participating in the agreement, including their names and addresses.

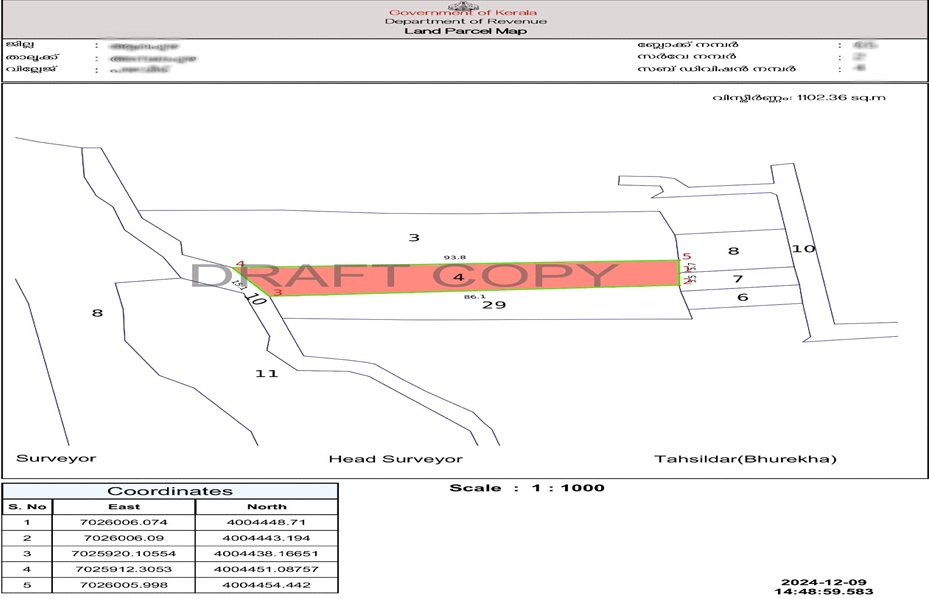

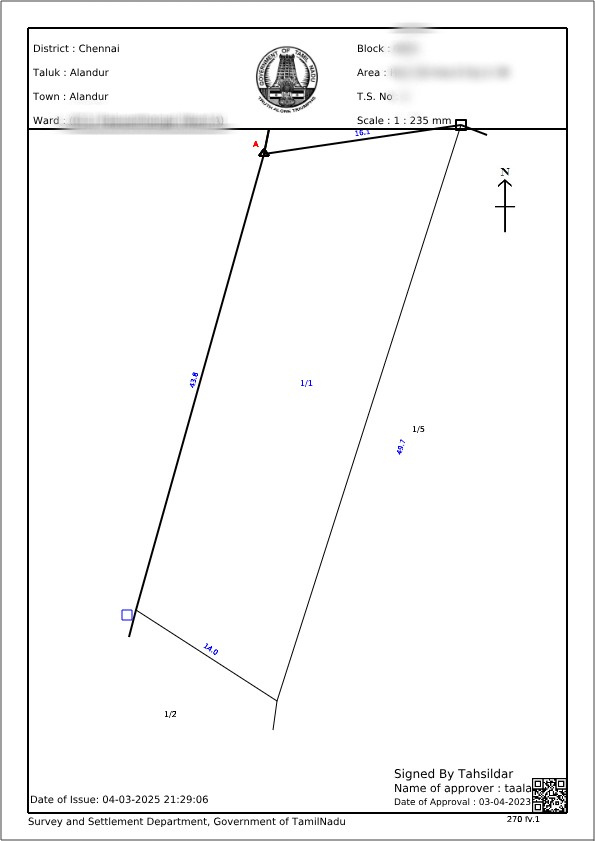

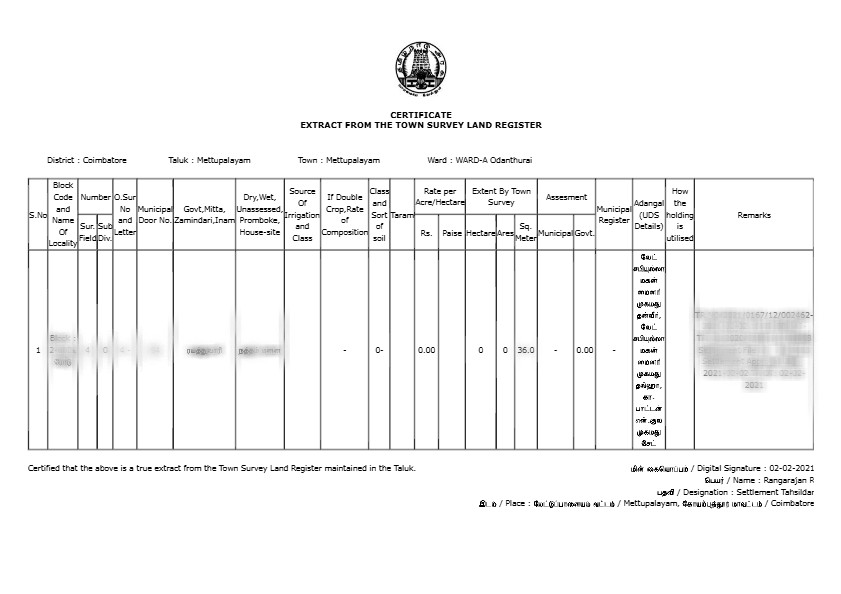

- Description of Property: Detailed information about the property in question is provided, including location and specific characteristics.

- Terms of Settlement: This crucial part outlines the agreed-upon terms, including how the property will be divided or any liabilities assigned.

- Legal Signatures: The document must be signed by all parties to signify consent and understanding.

These components work together to create a comprehensive and enforceable document that safeguards the interests of all parties involved.

Legal Aspects of a Settlement Deed

Understanding the legal framework surrounding a settlement deed is crucial for parties involved in property transactions. This includes recognizing its binding nature and the steps for proper registration and execution, which ensure enforceability.

Binding Nature and Validity

A settlement deed serves as a binding agreement between the parties involved. Once executed and registered, it creates legal obligations that both parties must fulfill. The document outlines specific terms, such as ownership transfer, financial responsibilities, and other conditions agreed upon by the parties.

Key Elements of Binding Nature:

- Mutual Consent: All parties must agree to the terms.

- Legal Capacity: Parties must have the legal ability to enter into the agreement.

- Clarity of Terms: Well-defined conditions minimize disputes in the future.

Any breach can lead to legal action, emphasizing the importance of comprehensive drafting and understanding of the deed’s implications.

Registration and Execution Process

The registration of a settlement deed is a critical step that adds legal validity to the agreement. This process typically involves several key actions.

Steps in Registration:

- Drafting the Deed: A professional should prepare the document to ensure accuracy and compliance with legal requirements.

- Signing: All parties must sign in the presence of witnesses.

- Registration: The deed must be submitted to the local sub-registrar office for official recording.

Failure to register can lead to issues in enforcement. Additionally, the registration process often involves payment of stamp duty, which varies depending on the property’s value and local regulations. Proper execution ensures that the deed can withstand legal scrutiny in case of disputes.

Types of Settlement Deeds

Settlement deeds can be classified into various categories, each serving distinct purposes based on the nature of the agreement. This section explores two primary types: Voluntary Settlement Deeds and Compulsory Settlement Deeds.

Voluntary Settlement Deed

A Voluntary Settlement Deed is created when parties agree to resolve their disputes without external pressure. This agreement typically emerges from negotiations between the involved parties, aiming for a mutual understanding.

Key features include:

- Mutual Agreement: Both parties willingly enter into the deed.

- Flexibility: The terms can be tailored to suit the specific needs of the parties.

- Legal Binding: Once executed, it holds legal validity.

Such deeds are beneficial in real estate transactions or family disputes, allowing parties to settle matters amicably. They foster cooperation and can prevent prolonged litigation.

Compulsory Settlement Deed

In contrast, a Compulsory Settlement Deed arises from legal mandates or court orders. This type of deed ensures that certain disputes are settled under prescribed conditions set by judicial authorities.

Characteristics include:

- Court Involvement: The settlement is often overseen by a court.

- Mandatory Compliance: Parties are legally obligated to adhere to the terms.

- Structured Process: The deed must conform to specific legal standards.

This type of deed is commonly employed in inheritance cases or business disputes, ensuring that resolutions align with legal frameworks. It provides a reliable pathway to conflict resolution while safeguarding the rights of all parties involved.

Settlement Deed Considerations

When entering into a settlement deed, various critical factors must be taken into account. These considerations include tax implications and the potential for revocation and amendments, which can significantly impact the parties involved.

Tax Implications

Settlement deeds can have notable tax consequences. Depending on the nature of the transaction, parties may need to consider capital gains tax liabilities. If a property is transferred as part of the settlement, the seller may incur capital gains tax if the property has appreciated in value.

Additionally, the terms of the settlement can affect deductibility. For example, if it involves financial compensation for disputes, the receiving party could face income tax on the settlement amounts. It is essential for involved parties to consult a tax professional to ensure compliance and plan accordingly.

Revocation and Amendments

The possibility of revocation and amendments to a settlement deed is another important consideration. A settlement deed requires mutual consent from all parties for any changes to be made. This means all parties must agree to new terms or modifications to existing conditions.

Revocations are possible but should be done in accordance with pre-established legal frameworks. If one party wishes to revoke the deed, the reasons need to be well-documented. Legal advice is advisable to navigate the complexities of any changes to ensure all amendments are enforceable and meet the legal prerequisites.

FAQs

What are the key differences between a settlement deed and a gift deed?

A settlement deed outlines the division of assets among parties, usually in dispute situations, while a gift deed involves the voluntary transfer of property without any consideration. The intent behind these documents is crucial; settlement deeds address conflicts, whereas gift deeds celebrate generosity.

Can you explain the validity of a settlement deed in legal terms?

The validity of a settlement deed hinges on compliance with statutory requirements, which may include proper execution, registration, and adherence to applicable laws. In India, a settlement deed generally requires registration under the Registration Act to be considered legally recognized and enforceable.

What should be included in a settlement deed to be considered legally binding?

For a settlement deed to be legally binding, it must include essential elements such as a clear title, detailed terms of settlement, identification of parties involved, and signatures from all parties. Additionally, it should be executed on a non-judicial stamp paper, as per the regulations of the relevant state.

How does a settlement deed differ from a sale deed?

A settlement deed focuses on resolving disputes and redistributing property among parties, while a sale deed involves a transfer of ownership for monetary compensation. The intention behind each document is distinct; settlement deeds aim to settle differences, whereas sale deeds facilitate transactions.

What are the legal implications of a settlement deed among family members?

When used among family members, a settlement deed serves to clarify and resolve property disputes or inheritance issues. It provides a documented agreement, which may help preclude future conflicts and can be legally enforced if properly executed, thus ensuring transparency and mutual understanding.

How is the transfer of property through a settlement deed executed in the context of Indian law?

In India, transferring property through a settlement deed requires drafting a written agreement that specifies the terms agreed upon by the parties. This deed must then be executed on stamp paper and registered with the local sub-registrar to attain legal validity and enforceability.