What is Land Market Value in Telangana?

The land market value is a crucial factor in any property transaction in Telangana. It is the minimum value at which a property can be registered, as determined by the government. This value, also known as the guideline value or circle rate, is essential for calculating stamp duty and registration fees, ensuring transparency and preventing undervaluation in property transactions. For legal purposes, the stamp duty is always calculated on the higher of the two—the registered price or the government’s guideline value.

Key Features of Land Market Value in Telangana

Understanding the market value of property is vital for both buyers and sellers. It serves several key purposes:

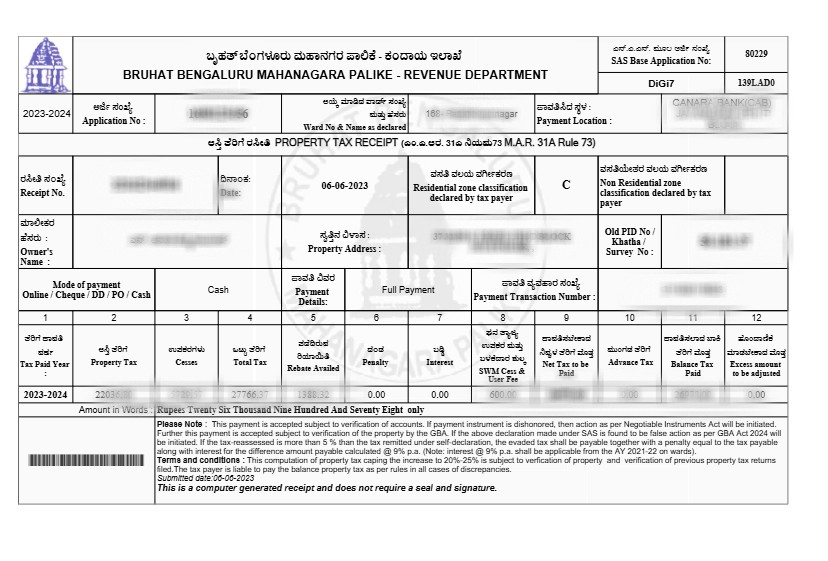

Determines Stamp Duty and Fees: The guideline value is the basis for calculating stamp duty, transfer duty, and registration fees. The higher the value, the more you pay in taxes, which makes it a critical part of the overall cost of a property.

Prevents Undervaluation: The government uses the circle rate to prevent people from declaring a lower transaction value to evade taxes. This ensures fair revenue collection for the state.

Benchmark for Property Valuation: It acts as a benchmark for property valuation, providing a baseline for a property’s worth. This is especially useful for banks when assessing a house value for a loan or mortgage.

Legal and Financial Clarity: It provides clarity in legal matters, such as property disputes, inheritance, or capital gains calculations.

How to Check Land Market Value Online in Telangana

You can check the land market value of property online using your survey number through mypatta.in.

- Open the mypatta app or website and log in or sign up if needed.

- Ensure “Telangana” is selected as the state, then tap the “Land Market Value” icon

- Choose”Agriculture” or ”Non Agriculture” tab

- Enter the required details:

- Tap Get Market Value to fetch your land records.

- Once Land Market Value is available to download, tap “View Document”. You can now save or share or download this document in PDF on your device.

What information does Land Market Value contain in Telangana

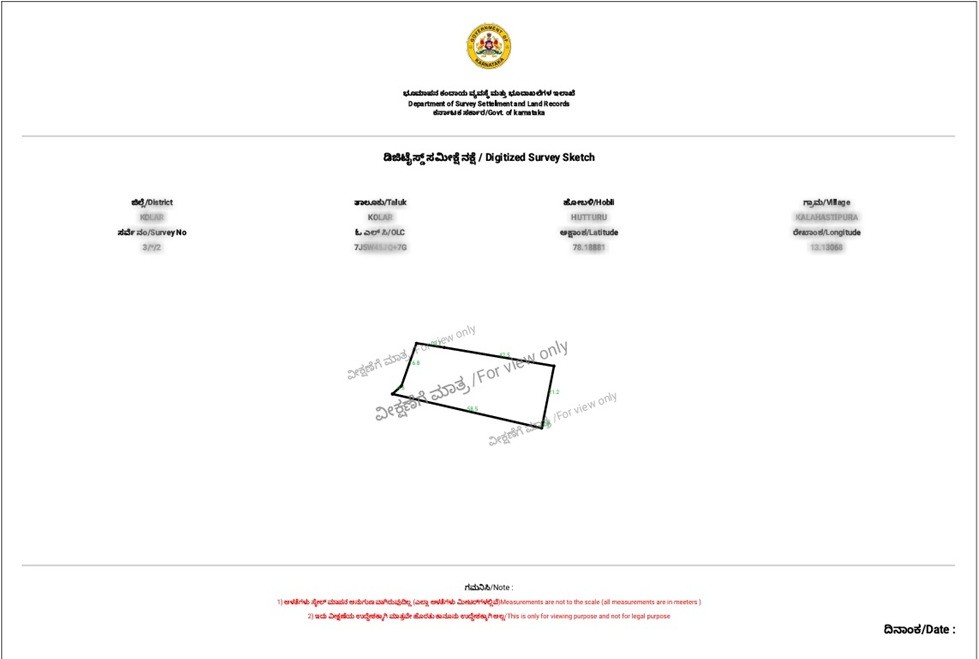

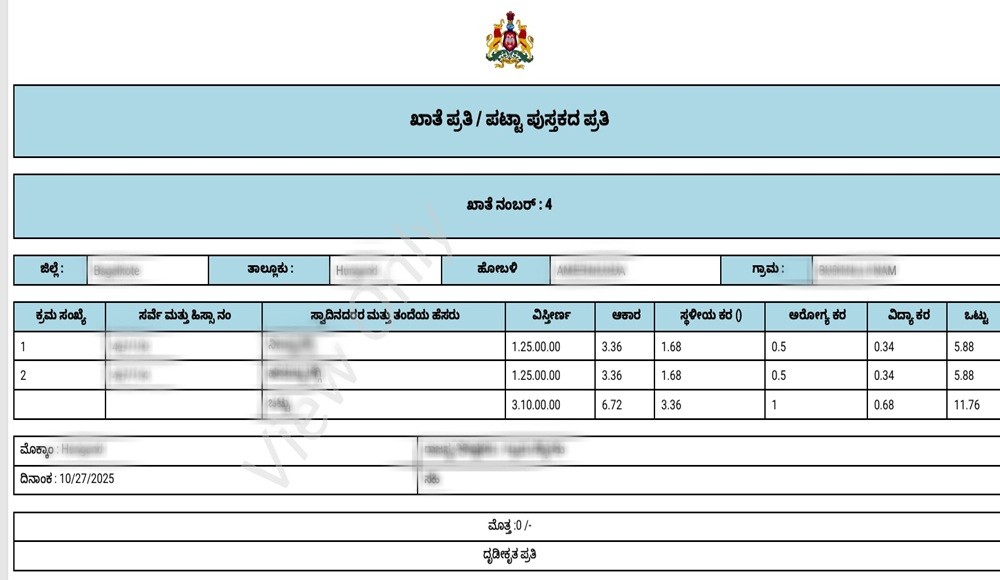

Location Details: The document specifies the property’s location by providing the district, mandal, and village names. This helps determine the specific rate for the area.

Survey Number: It includes the survey number of the land parcel. This unique identifier ensures the valuation is specific to that exact piece of land.

Property Type: The document distinguishes between agriculture and non-agriculture land, as each has a different valuation. It might also specify the classification, such as residential, commercial, or industrial.

Unit Rate: The most important information is the guideline value itself. This is listed as a rate per unit of area, such as per square yard for plots or per acre for agricultural land.

Effective Date: It will show the date from which the listed value is effective, as the market value of property is revised periodically.

This information is crucial for performing a property valuation and using a stamp duty calculator to determine the total cost of a transaction.

Frequently Asked Questions(FAQs)

1.What is the difference between market value and stamp duty?

The market value is the minimum property value set by the government, while stamp duty is a tax paid during property registration, calculated as a percentage of the property value.

2.Can market value affect my property loan amount?

Yes, banks often consider the market value as one of the factors while determining the loan amount for a property.

3.Can the government market value be lower than the sale price?

Yes, sale price can be higher, but it cannot be lower than the notified market value during registration.

4.How is stamp duty calculated using market value?

Stamp duty is calculated on the higher of sale price or market value, at a fixed percentage.

5.How often is the market value updated?

Telangana government revises market values periodically based on market trends.

Key Takeaway

The Land Market Value in Telangana is a key record for property transactionsWith the mypatta.in platform, you can quickly and easily check the land market value online using the survey number and other details. This helps you with accurate property valuation and the calculation of stamp duty, and you can download the official documents with just a few clicks.