Agricultural land tax is a crucial aspect of land ownership in Andhra Pradesh, India. It is a tax levied on agricultural land and is an important source of revenue for the state government. The tax is calculated based on the area of the land, its fertility, and its location.

The revenue generated from agricultural land tax is used for various developmental activities in the state, including infrastructure development, agricultural subsidies, and welfare programs for farmers. In Andhra Pradesh, agricultural land tax is governed by the Andhra Pradesh Agricultural Land (Conversion for Non-Agricultural Purposes) Act, 2006. The Act provides the legal framework for the assessment and collection of agricultural land tax in the state.

It also outlines the procedures for the conversion of agricultural land for non-agricultural purposes and the payment of tax in such cases. Understanding the provisions of this Act is essential for landowners in Andhra Pradesh to ensure compliance with the law and avoid penalties for non-payment or late payment of agricultural land tax.

Key Takeaways

- Agricultural land tax in Andhra Pradesh is a mandatory tax imposed on agricultural landowners by the state government.

- Calculating agricultural land tax involves considering factors such as land type, land use, and land area.

- Payment options for agricultural land tax in Andhra Pradesh include both online and offline methods for the convenience of landowners.

- There are exemptions and deductions available for certain categories of landowners, such as small and marginal farmers.

- It is important to be aware of the deadlines for agricultural land tax payment and the penalties for late payment to avoid additional costs.

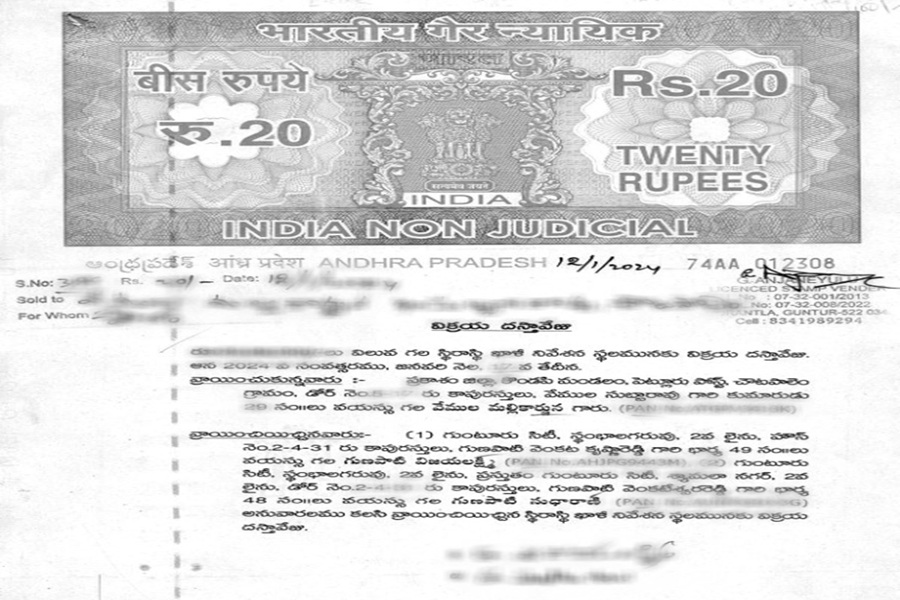

- Landowners must obtain and submit necessary documents such as land ownership proof and land use details for agricultural land tax assessment.

- Efficient management and budgeting for agricultural land tax payments can be achieved through proper record-keeping and financial planning.

Step-by-Step Guide to Calculating Agricultural Land Tax

Calculating agricultural land tax in Andhra Pradesh involves several steps. The first step is to determine the classification of the land based on its fertility and location. The land is classified into different categories such as irrigated, partially irrigated, and dry land, and the tax rates vary for each category.

Once the classification is determined, the next step is to calculate the area of the land in acres or hectares. The tax is then calculated based on the area and the applicable tax rate for the land category. After calculating the basic tax amount, additional charges such as water cess and education cess may also be applicable, depending on the location of the land.

These charges are calculated as a percentage of the basic tax amount and are added to the total tax liability. It is important to note that the tax rates and charges may vary from year to year, so it is essential to refer to the latest government notifications for accurate calculations. Once the total tax liability is determined, landowners can proceed to make the payment through online or offline modes as per their convenience.

Online and Offline Payment Options for Agricultural Land Tax

In Andhra Pradesh, landowners have the option to pay agricultural land tax through both online and offline modes. The online payment facility provides a convenient and hassle-free way to pay taxes from anywhere with an internet connection. Landowners can visit the official website of the Andhra Pradesh Revenue Department and select the option for agricultural land tax payment.

They can then enter the required details such as their land assessment number, name, and contact information, and proceed to make the payment using net banking, credit/debit cards, or other online payment methods. Alternatively, landowners can also choose to pay agricultural land tax through offline modes such as designated bank branches or e-Seva centers. They can visit any authorized bank branch or e-Seva center with their land assessment details and make the payment in cash or through a demand draft.

After making the payment, they will receive a receipt as proof of payment, which should be retained for future reference. Both online and offline payment options are secure and reliable, and landowners can choose the method that best suits their preferences and convenience.

Exemptions and Deductions for Agricultural Land Tax in Andhra Pradesh

In Andhra Pradesh, certain categories of agricultural land are eligible for exemptions or deductions from agricultural land tax. For example, lands used for specific agricultural purposes such as horticulture, floriculture, or sericulture may be eligible for a reduced tax rate or complete exemption from tax. Similarly, lands used for social forestry or agro-forestry activities may also qualify for exemptions or deductions.

Additionally, small and marginal farmers with limited land holdings may be eligible for special concessions on agricultural land tax as per government regulations. To avail of these exemptions or deductions, landowners must submit the necessary documents and applications to the concerned revenue authorities for verification and approval. It is important to carefully review the eligibility criteria and documentation requirements for exemptions and deductions and ensure compliance with the prescribed procedures.

By taking advantage of these provisions, landowners can reduce their tax liabilities and optimize their financial resources for agricultural activities and development.

Important Deadlines and Penalties for Late Payment

In Andhra Pradesh, agricultural land tax payments are due on specific dates as prescribed by the state government. It is crucial for landowners to be aware of these deadlines and ensure timely payment to avoid penalties or legal consequences. Failure to pay agricultural land tax within the stipulated time frame may attract penalties such as interest charges or fines, which can significantly increase the total tax liability.

Therefore, it is advisable for landowners to mark the due dates on their calendars and set reminders to avoid missing the payment deadlines. In case of late payment, landowners should promptly settle their outstanding tax liabilities along with any applicable penalties to avoid further escalation of dues. It is important to note that non-payment or delayed payment of agricultural land tax can lead to legal action by the revenue authorities, including attachment of the land or other enforcement measures.

To prevent such situations, landowners should prioritize timely payment of agricultural land tax and allocate sufficient funds in their budget for this purpose.

How to Obtain and Submit the Necessary Documents for Agricultural Land Tax

To comply with the requirements for agricultural land tax in Andhra Pradesh, landowners must obtain and submit certain documents as per the prescribed procedures. The primary document required for tax assessment is the land passbook or title deed, which contains details such as survey numbers, area of the land, classification, and ownership information. Landowners should ensure that their land passbooks are updated with accurate information to facilitate smooth assessment and calculation of agricultural land tax.

In addition to the land passbook, other documents such as income certificates, caste certificates (if applicable), and proof of agricultural activities may also be required for availing exemptions or deductions from agricultural land tax. These documents should be obtained from the relevant authorities and submitted along with the tax payment or exemption applications as per the specified timelines. It is essential to maintain proper records of all submitted documents and receipts for future reference and audit purposes.

Tips for Efficiently Managing and Budgeting for Agricultural Land Tax Payments

Managing agricultural land tax payments effectively is essential for landowners in Andhra Pradesh to ensure financial stability and compliance with legal obligations. To achieve this, it is advisable to create a dedicated budget for agricultural land tax payments and allocate funds accordingly. By estimating the annual tax liability based on previous assessments and current rates, landowners can plan their finances proactively and avoid last-minute financial strain.

Furthermore, staying informed about any changes in tax rates or deadlines through official notifications from the revenue authorities is crucial for accurate budgeting and planning. Landowners should regularly monitor their communication channels such as email, SMS alerts, or official websites for updates on agricultural land tax-related matters. Seeking professional advice from financial advisors or tax consultants can also provide valuable insights into optimizing tax management strategies and maximizing available benefits.

In conclusion, paying agricultural land tax in Andhra Pradesh requires a thorough understanding of the legal provisions, calculation methods, payment options, exemptions, deadlines, documentation requirements, and budgeting strategies. By following a systematic approach and staying informed about relevant developments, landowners can fulfill their tax obligations efficiently while leveraging available benefits to support their agricultural activities and contribute to the state’s development initiatives.

FAQs

What is agricultural land tax in Andhra Pradesh?

Agricultural land tax is a tax levied on agricultural land in Andhra Pradesh, which is payable by the landowner.

Who is required to pay agricultural land tax in Andhra Pradesh?

The landowner or the person in possession of the agricultural land is required to pay the agricultural land tax in Andhra Pradesh.

How can agricultural land tax be paid in Andhra Pradesh?

Agricultural land tax in Andhra Pradesh can be paid through online or offline modes. Online payment can be made through the official website of the Andhra Pradesh government, while offline payment can be made at designated government offices.

What are the documents required for paying agricultural land tax in Andhra Pradesh?

The documents required for paying agricultural land tax in Andhra Pradesh include the land ownership documents, land survey number, and other relevant identification documents.

What is the deadline for paying agricultural land tax in Andhra Pradesh?

The deadline for paying agricultural land tax in Andhra Pradesh is typically set by the Andhra Pradesh government and may vary from year to year. It is important to pay the tax within the specified deadline to avoid penalties.