A Khata Extract is an official document issued by the Revenue Department of Karnataka that provides detailed information about a property as recorded in their property register. Also referred to as Bhoomi Khata Extract, it is essential for property verification and legal purpose

How to Download Karnataka Khata Extract Quickly Online?

- Open mypatta and log in or sign up if needed.

- Select State as Karnataka

- Provide District, Taluka, Hobli/Town, Village and Khata Number

- Once the Khata Extract Download is made available,you can download Khata Extract, save, or share it.

Through mypatta,you can access your Khata Extract online quickly without any worries.

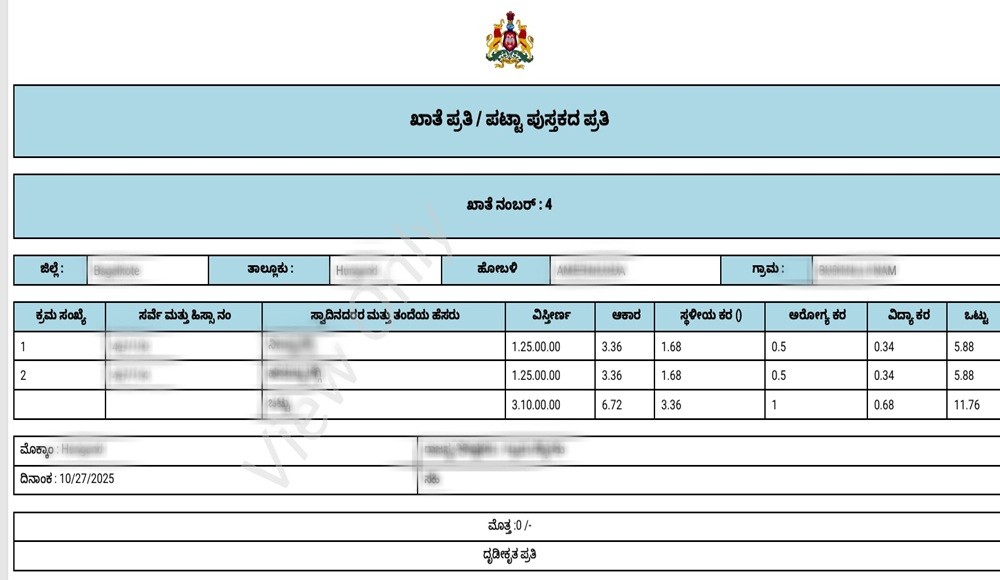

How to read & understand Karnataka Khata Extract?

Karnataka Khata Extract contains important information which can help in Verify Ownership, Buy or Sell Property, Legal Dispute Resolution, Loan Applications, Building Plan Approvals. In Khata Extract you will find –

- Property Owner Details – Current owner’s name and address.

- Property Identification – Unique Property ID

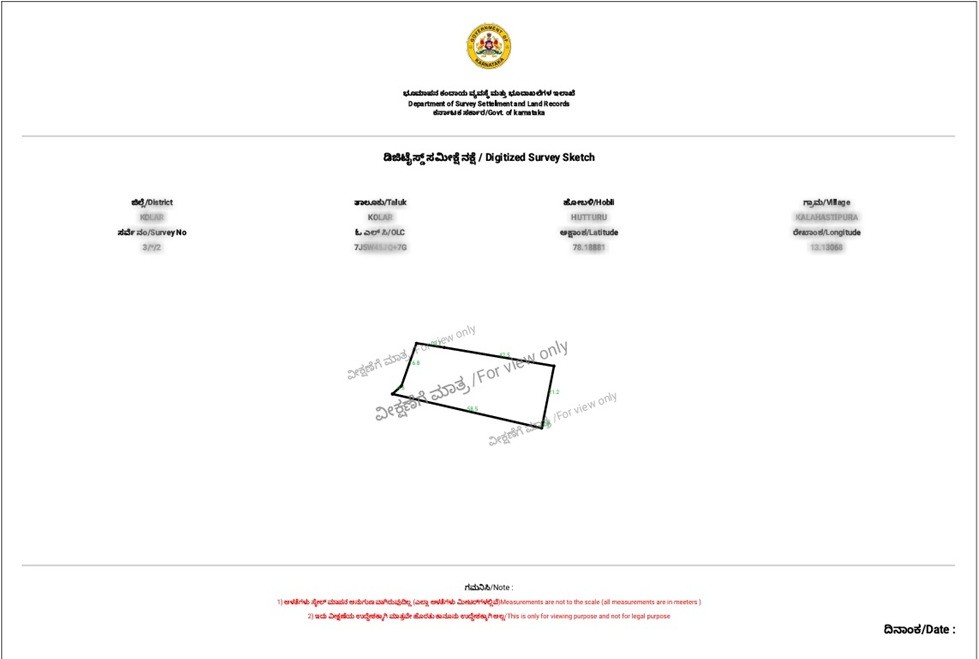

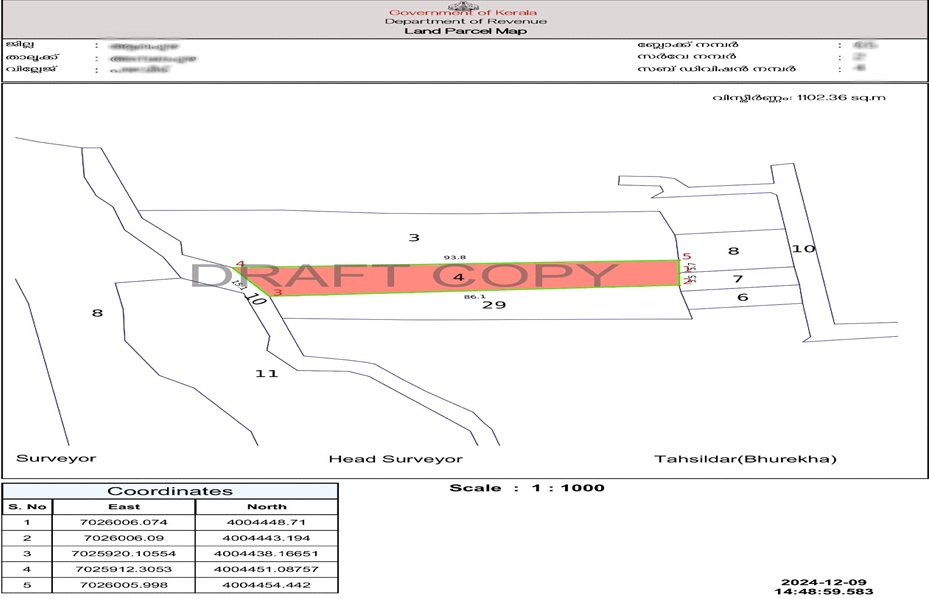

- Land Extent & Dimensions – Area in square feet/meters with site measurements.

- Location Details –District, locality, and survey/subdivision number.

Who Should Have Karnataka Khata Extract?

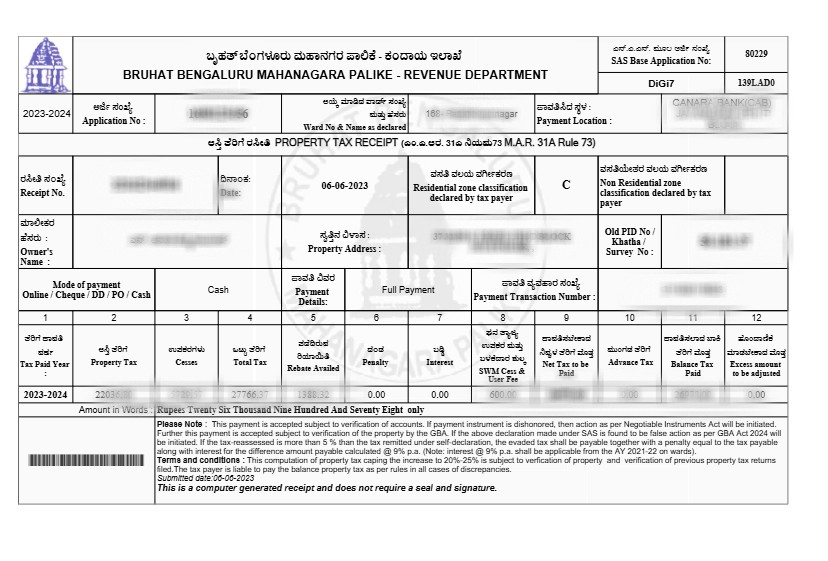

- Property Owners – To prove property ownership and for property tax assessment.

- Buyers – To verify property details and ensure it has a valid Khata before purchase.

- Builders & Developers – For obtaining building approvals and construction permits.

- Banks & Financial Institutions – For processing property loans and mortgage verification

Why you should download Karnataka Khata Extract through mypatta?

- 🧑🤝🧑Trusted by 3 Lakh+ customers

- 📥 50 Lakh+ Documents delivered

- 🛡️ mypatta Guarantee – Your money is safe with us – guaranteed delivery or 100% amount refund.

Frequently Asked Questions (FAQs)

1.How long is a Khata Extract valid?

A Khata Extract remains valid unless there is a change in ownership, property size, or usage. It’s good to download a fresh copy before legal transactions.

2.Can I use Khata Extract for income tax purposes?

Yes, Khata Extract is often submitted along with property tax receipts and sale deeds while claiming exemptions or filing for property-related income in ITR.

3. Does Khata Extract include encumbrance details?

No. The Khata Extract only shows municipal records, not the property’s transaction or mortgage history. For that, you need an Encumbrance Certificate (EC).

4.Can tenants or buyers request a copy of the Khata Extract?

Only the registered property owner or their legal representative can apply for a Khata Extract. However, buyers can ask the seller to provide it during due diligence.

5. Is Khata Extract the same as property ownership proof?

No. While it supports your claim, the true legal proof of ownership is the registered sale deed. The Khata Extract shows property details, not legal title.

Need help? Contact us on – +91 9177458818