A Property Tax Receipt is an official proof issued by local authorities confirming property tax payment for a specific period. It helps maintain updated municipal records and supports hassle-free approvals for property-related services or transfers.

How to Download Tamil Nadu Property Tax Receipt Quickly Online ?

- Open mypatta and log in or sign up if needed.

- Select State as Tamil Nadu

- Choose Rural or Urban tab

- Provide District,Block,Village Panchayat,Assessment number and Receipt Language

- Once the Property Tax Receipt is made available, you can download, save, or share it

Through mypatta,you can get Property Tax Receipt in the fastest way without any worries.

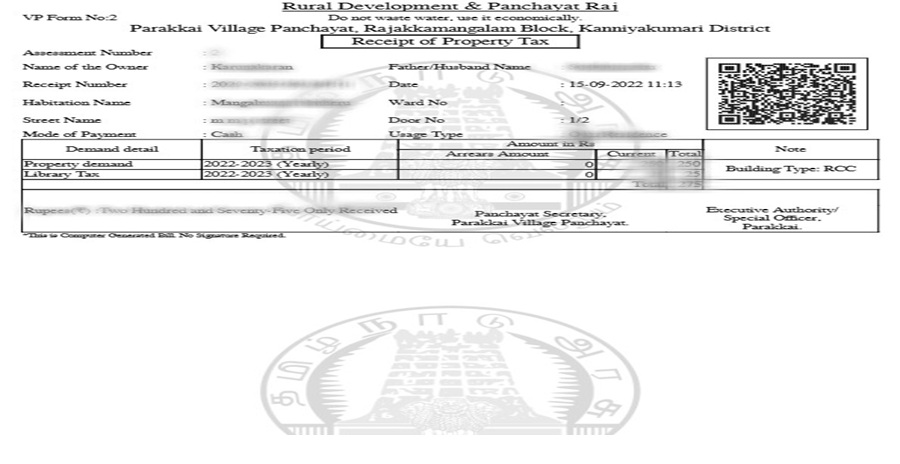

How to read & understand Tamil Nadu Property Tax Receipt ?

Tamil Nadu Property Tax Receipt contains important information which can help in Proof of Payment, Loan Applications, Buy or Sell Property, Legal Compliance, Record Keeping. In Property tax receipt you will find –

- Assessment Number – Unique property tax identifier

- Name of Owner – Registered property holder name

- Father/Husband Name – Parent or spouse details

- Receipt Number – Payment reference identification number

- Ward, Door Number and Street Name – Exact property location details

- Mode of Payment – Method used for payment

- Demand Detail – Tax amount requested or due

- Taxation Period – Duration of assessed tax

- Arrears Amount – Outstanding or unpaid tax balance

Who should have Tamil Nadu Property Tax Receipt?

- Property owners for proof of property tax payment and ownership

- Buyers for verifying property tax status before purchase

- Or anyone who needs it for loans or record-keeping purposes

Why you should download Tamil Nadu Property Tax Receipt through mypatta?

- 🧑🤝🧑 Trusted by 5 Lakh+ customers

- 📥 50 Lakh+ Documents delivered

- 🛡️ mypatta Guarantee – Your money is safe with us – guaranteed delivery or 100% amount refund.

Frequently Asked Questions (FAQs)

1.Can I use a property tax receipt as proof of ownership?

A property tax receipt only confirms tax payment. It does not serve as proof of ownership. Ownership must be verified through documents like the Sale Deed or Title Deed or Certified Copy, which you can get from our Certified Copy/Nakal option in mypatta .

2.Can tenants use the property tax receipt as address proof?

No, it is issued in the owner’s name and is not valid address proof for tenants.

3.Are property tax receipts transferable if I sell my property?

No, the receipts are tied to the property, not the owner. However, the new owner will need the previous receipts to verify that all taxes are up to date.

4.What should I do if there is an error in my Property Tax Receipt?

Contact your local authority (municipality/village panchayat) with the receipt and supporting documents to correct errors

5.Is the property tax amount the same every year?

It usually remains the same unless there is a change in building status, property use, or government revision.

Key Takeaway

- The Property Tax Receipt in Tamil Nadu is essential for proving timely tax payment and maintaining a clean ownership record.

- It is required for property verification, loan processing, and smooth municipal updates.

- With mypatta, you can instantly download your property tax receipt online without visiting the government office.

- Stay compliant, avoid penalties, and ensure secure property transactions using mypatta’s online tax receipt service.

Need help? Contact us on +91 9177458818